Norway's sovereign wealth fund trims Malaysian equity exposure, ramps up investments in bonds

KUALA LUMPUR (Aug 14): Norway’s sovereign wealth fund dumped some Malaysian stocks in the first six months of 2025, shrinking its equity investments in the country, its latest data showed.

Formally known as Government Pension Fund Global (GPFG), the fund trimmed its holdings to 209 Malaysian stocks worth US$2.53 billion by June-end, according to The Edge’s analysis of its half-yearly disclosure. That compares to 217 firms valued at US$2.71 billion on its books as at end 2024.

While its equity investments declined, the fund more than tripled its holdings of Malaysian government bonds and added bonds issued by national oil-and-gas company Petroliam Nasional Bhd, or Petronas, to its fixed income portfolio now valued at US$610 million.

GPFG is the world’s single-largest investor, owning a small stake in about 8,500 companies across most countries and industries.

The fund, which owns nearly US$2 trillion worth of investments, is managed by the Norwegian central bank to invest the surplus revenues from the country’s petroleum sector.

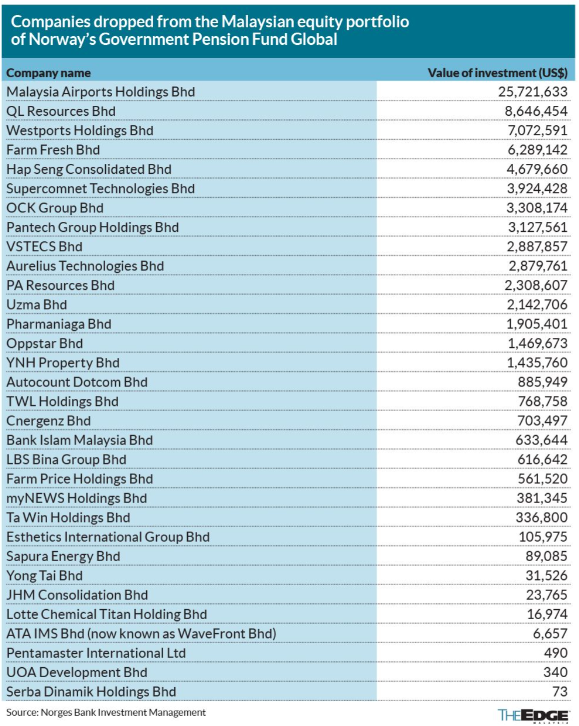

In Malaysia, GPFG exited 32 companies during the first half of 2025, including Malaysia Airports Holdings Bhd, which was privatised earlier this year, QL Resources Bhd (KL:QL), Westports Holdings Bhd (KL:WPRTS), Farm Fresh Bhd (KL:FFB) and Hap Seng Consolidated Bhd (KL:HAPSENG).

The fund also significantly reduced its exposure in stocks such as Iskandar Waterfront City Bhd (KL:IWCITY) to 2.61% from 5.02%, and Cahya Mata Sarawak Bhd (KL:CMSB) to 1.46% from 3.86%.

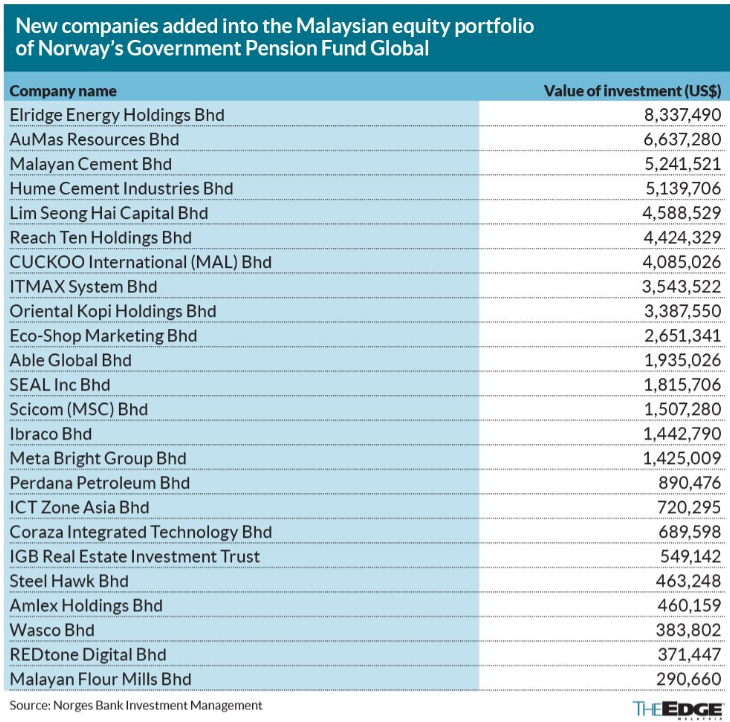

Among the 24 new additions were Elridge Energy Holdings Bhd (KL:ELRIDGE), AuMas Resources Bhd (KL:AUMAS) Malayan Cement Bhd (KL:MCEMENT), Hume Cement Industries Bhd (KL:HUMEIND) and Lim Seong Hai Capital Bhd (KL:LSH).

Investments in several counters were also increased, most notably in Pentamaster Corp Bhd (KL:PENTA), which rose to 5.07% from 1.62%.

In terms of sectors, financials accounted for more than one-third of GPFG’s Malaysian equity portfolio, followed by industrials at 18%, and consumer staples at 8% as at end-June 2025.

However, GPFG does not have any investments in private real estate or unlisted renewable energy infrastructure in the country.

All in all, GPFG’s investments in Malaysia totalled US$3.14 billion, equivalent to about 0.2% of its global portfolio.

Globally, the fund produced a return of 5.7% in the first half of 2025. Equity investments generated a return of 6.7%, fixed income 3.3%, and investments in unlisted real estate 4%. The return on unlisted renewable energy infrastructure was over 9%.

"The result is driven by good returns in the stock market, particularly in the financial sector," said Nicolai Tangen, the chief executive of Norges Bank Investment Management that manages GPFG.

By asset classes, 70.6% of the fund was invested in equities and 27.1% in fixed income. Unlisted real estate made up 1.9% of its assets and the remaining 0.4% was in unlisted renewable energy infrastructure.